Toronto, Ontario–(Newsfile Corp. – January 14, 2021) – Stratabound Minerals Corp. (TSXV: SB)

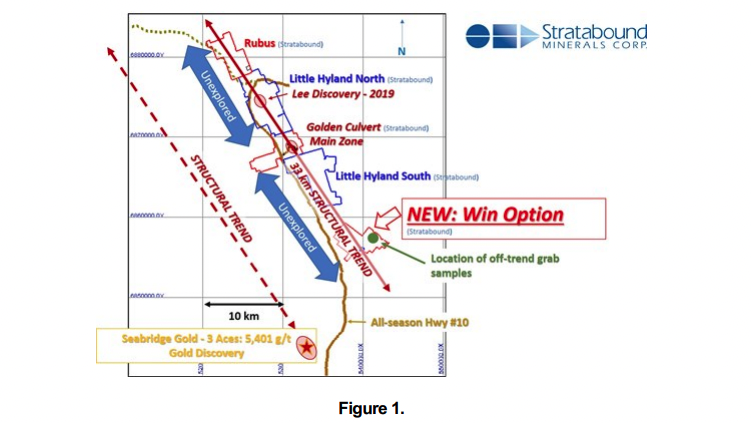

(OTC Pink: SBMIF) (“Stratabound” or the “Company”) announced today it has concluded an armslength option agreement (the “WinOption”) to acquire an additional 78 quartz mining claims covering an

area of 15.7 km2 adjacent to and along strike of its Golden Culvert and Little Hyland projects in the

southeastern Yukon Territory. The Company now controls a total of 99.1 km2 along approximately 28 km

of favourable strike in the developing Hyland Gold Trend.

The WinOption lies strategically along the mainGolden Culvert Gold Trend where it projects

approximately 11 km directly southeast of the Main Discovery area (Figure 1). The WinOption has been

subjected to minimal historic exploration which has neither been gold-focussed nor occurring within the

projected gold trend. Even so, one historic off-trend grab* sample yielding 0.52 g/t gold,100 g/t silver and

0.63% lead has been confirmed by the Company’s 2020 due diligence site investigation which yielded

two outcrop samples assaying 0.64 g/t gold, 155 g/t silver,1.25% lead and, 0.46 g/t gold, 28.8 g/t silver,

respectively.

(*Note: Grab samples are selective by nature and may not represent the true grade or style of

mineralization)

https://orders.newsfilecorp.com/files/4064/72070_87fa1bd13437cbee_002full.jpg

Mr. R. Kim Tyler, President and CEO of the Company stated, “We are very pleased to have concluded a

successful option agreement on the Win Property and the increased opportunity it affords to find more

gold occurrences such as found to date along the Golden Culvert and the parallel 3 Aces trends. We look

forward to including it in our exploration plans along with the Golden Culvert and Little Hyland Projects in

2021.”

WinOption Agreement:

Stratabound has signed a definitive option agreement (the “Agreement”) which sets out the terms under

which Stratabound has the option to earn 100% interest in 78 claims comprising 15.7 km2

located south

of the Company’s existing optioned claims through cash payments and share issuances. Upon execution

of the Agreement, Stratabound shall make a cash payment of $13,400 and within 10 days of execution

of the Agreement, Stratabound shall issue 117,300 common shares to the owner, subject to TSXV

approval. Payments on the first, second, third, fourth and fifth anniversaries of execution of the

Agreement of $13,400, $20,100, $20,100, $26,800 and $40,200 respectively, totaling $134,000 in the

aggregate, are required to maintain the option. Stratabound shall also incur exploration expenses of at

least $35,000 on or before the first anniversary date of the execution of the Agreement. Upon completion

of all payments, issuing shares and incurring the required exploration expenditures up to and including

the third anniversary payment, Stratabound shall have earned 50% ownership in the claims. Upon

completion of all payments up to and including the fifth anniversary payment, Stratabound shall have

earned 100% ownership in the claims. Stratabound has the option to accelerate the payments to

exercise the option sooner. Stratabound has also agreed to pay the owner a 2% net smelter return

royalty (“NSR”) on production from the claims of which 1.5% may be bought back in increments of $0.5M

for each 0.5% of the NSR.

Quality Assurance/Quality Control

The samples referenced in this press release were collected and hand-delivered by Stratabound

personnel to the ALS Canada laboratory in Whitehorse, YT where they were crushed to 70% less than

2mm. A riffle split of 250 grams was then taken and pulverized to an 85% passing 75 microns pulp subsample. The pulps were then shipped by ALS Canada to its Vancouver laboratory for gold and multielement analyses. The Au-AA26 gold assaying procedure used is a standard fire assay with AA finish

technique on a 50-gram sub-sample taken from the 250-gram pulp split.

The samples were also tested for 51 other elements using the ME-MS41 Ultra Trace Aqua Regia ICPMS method. Over-limit results of silver and lead on one sample reported in this release were re-assayed

by the Ag-OG46 and Pb-OG46 ore grade methods. ALS uses a procedure of standards, blanks and

duplicates inserted into the sample stream results for which all fell within satisfactory confidence limits.

ALS is an independent internationally recognized and ISO/IEC 17025:2017 accredited chemical

analysis company.

About Stratabound Minerals Corp.

Stratabound Minerals Corp. is a fully-funded Canadian exploration and development company focused

on gold exploration at its flagship Golden Culvert Project, Yukon Territory and its McIntyre Brook Project,

New Brunswick, Canada. The Company also holds a significant land position that hosts three base

metals deposits in the Bathurst base metals camp of New Brunswick featuring the Captain CopperCobalt-Gold Deposit that hosts an NI 43-101 Measured and Indicated Resource.

Mr. R. Kim Tyler, P.Geo., President and CEO of Stratabound, and a “Qualified Person” for the purpose

of NI 43-101, has reviewed and approved the contents of this news release.

For more information please visit the company’s website at www.stratabound.ca or contact: R. Kim Tyler,

President and CEO 416-915-4157 info@stratabound.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this

release.

WARNING: The Company relies upon litigation protection for “forward looking” statements. The

information in this release may contain forward-looking information under applicable securities laws.

This forward-looking information is subject to known and unknown risks, uncertainties and other factors

that may cause actual results to differ materially from those implied by the forward-looking information.

Factors that may cause actual results to vary materially include, but are not limited to, inaccurate

assumptions concerning the exploration for and development of mineral deposits, currency fluctuations,

unanticipated operational or technical difficulties, changes in laws or regulations, failure to obtain

regulatory, exchange or shareholder approval, the risks of obtaining necessary licenses and permits,

changes in general economic conditions or conditions in the financial markets and the inability to raise

additional financing. Readers are cautioned not to place undue reliance on this forward-looking

information. The Company does not assume the obligation to revise or update this forward-looking

information after the date of this release or to revise such information to reflect the occurrence of future

unanticipated events, except as may be required under applicable securities laws.